stock option sale tax calculator

Calculate your potential gains after taxes. Your basis in the stock depends on the type of plan that granted your stock option.

How Stock Options Are Taxed Carta

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds.

. Click to follow the link and save it to your Favorites so. How much are your stock options worth. Stock Option Tax Calculator.

Find the best spreads and short options Our Option Finder tool. Ad For Private and Public Companies Who Want Equity Plans Done Right. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Those shares could be worth 10 per share or 1000 per share. 40 of the gain or loss is taxed at the short-term capital tax. Multiply the price of your item or service by the tax rate.

How to Calculate Sales Tax. Non-qualified Stock Option Inputs. And if you re-purchase the stock.

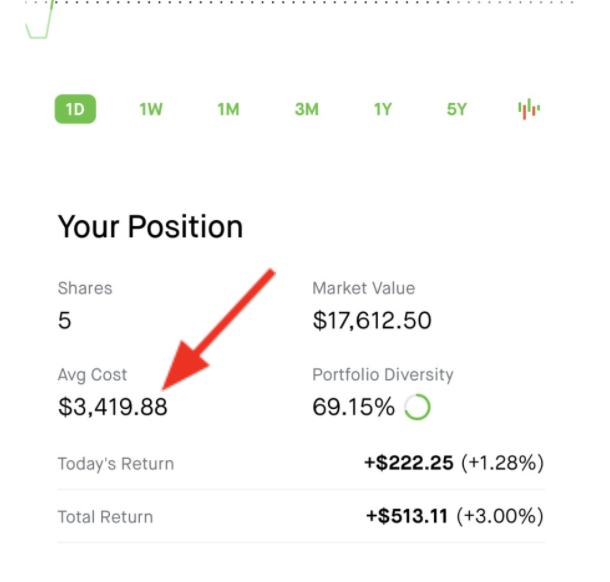

Enter the number of shares purchased. To arrive at your potential take-home gains youll need to subtract your costs from the resulting gain in the stocks value. All thats necessary to calculate the value of startup stock options is A the number of shares in the.

This permalink creates a unique url for this online calculator with your saved information. It can produce tremendous returns and you can climb the financial ladder quicked than many other options but timing like. This permalink creates a.

Taxes for Non-Qualified Stock Options. Exercise incentive stock options without paying the alternative minimum tax. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Section 1256 options are always taxed as follows. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Restricted stock units Calculator are the most sale alternative to stock options but they work very differently. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. 20062017 AlexPlatz 5 Comments.

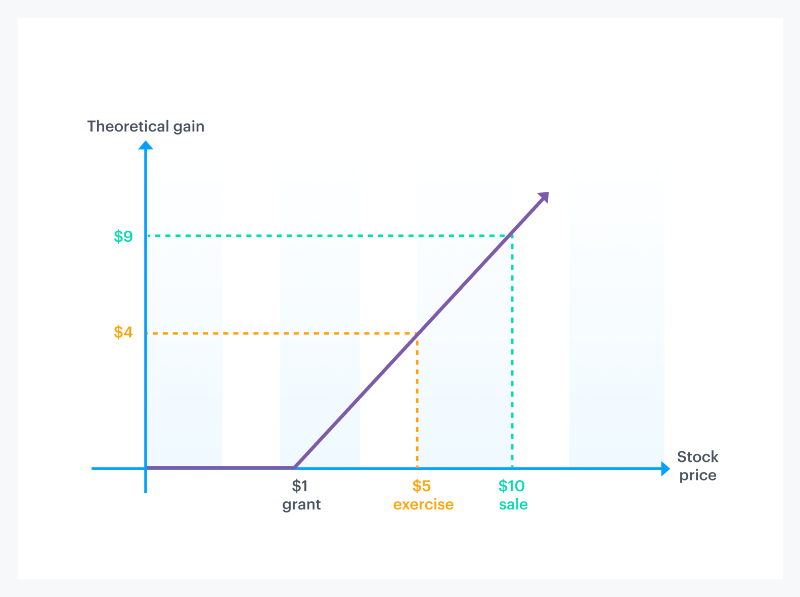

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. In our continuing example your theoretical gain is.

Ad For Private and Public Companies Who Want Equity Plans Done Right. Cash Secured Put calculator addedCSP Calculator. 60 of the gain or loss is taxed at the long-term capital tax rates.

On this page is an Incentive Stock Options or ISO calculator. Poor Mans Covered Call calculator addedPMCC Calculator. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the.

Exercising your non-qualified stock options triggers a tax. Capital Gains Tax Calculator. Ordinary income tax and capital gains tax.

The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. Please enter your option information below to see your potential savings. The Employee Stock Options Calculator.

Calculate the costs to exercise your stock options - including taxes. There are two types of taxes you need to keep in mind when exercising options. Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Lets say you got a grant price of 20 per share but when you exercise your. Use Stock Tax Calculator to calculate your capital returns in 2022.

Stock option sale tax calculator. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Calculate your potential gains after taxes.

The Stock Option Plan specifies the total number of shares in the option pool. The plan was an incentive stock option or statutory stock option. The number of shares acquired is listed in box 5.

The AMT adjustment is 1500 2500 box 4 multiplied by box 5 minus 1000 box 3 multiplied by box 5.

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Rsu Taxes Explained 4 Tax Strategies For 2022

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Understanding How The Stock Options Tax Works Smartasset

Woocommerce Sales Tax In The Us How To Automate Calculations

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Capital Gains Tax What Is It When Do You Pay It

Simple Tax Refund Calculator Or Determine If You Ll Owe

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Understanding How The Stock Options Tax Works Smartasset

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How To Calculate Cannabis Taxes At Your Dispensary

Rsu Taxes Explained 4 Tax Strategies For 2022

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)